|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding VA Loans in NJ: A Complete Beginner's GuideVA loans are a unique financing option available to veterans, active-duty service members, and certain members of the National Guard and Reserves. In New Jersey, these loans offer a pathway to homeownership with several benefits. This guide will explore the key aspects of VA loans in NJ. What Are VA Loans?VA loans are mortgage loans provided by private lenders, such as banks and mortgage companies, but guaranteed by the U.S. Department of Veterans Affairs (VA). This guarantee allows lenders to offer more favorable terms. Benefits of VA Loans

Eligibility RequirementsTo be eligible for a VA loan in NJ, you must meet certain service requirements. These include serving a specific number of days on active duty, being discharged under conditions other than dishonorable, or meeting other specific criteria for National Guard and Reserve members. Service RequirementsFor most veterans, you must have served at least 90 consecutive days during wartime or 181 days during peacetime. If you are currently serving, you need to have served 90 continuous days. Applying for a VA LoanApplying for a VA loan involves several steps. First, you need to obtain a Certificate of Eligibility (COE) from the VA. This document confirms your eligibility for the loan. The Application Process

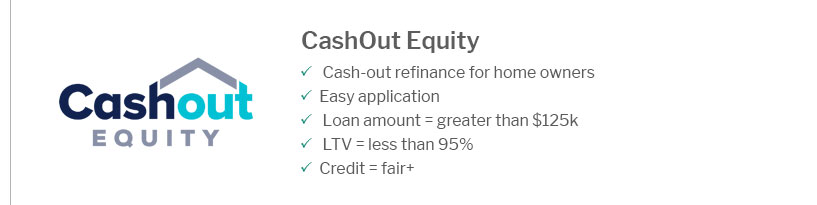

If you are exploring other financing options, you might consider best refinance rates in Texas to understand different market opportunities. VA Loan Limits in NJWhile the VA does not set a cap on how much you can borrow, it does limit the amount it will guarantee. These limits vary by county and are based on the conforming loan limits set by the Federal Housing Finance Agency. County Loan LimitsIn New Jersey, loan limits can vary significantly from one county to another. It's essential to check the specific limits for the county where you plan to buy. Frequently Asked QuestionsWhat credit score is needed for a VA loan?While the VA does not set a minimum credit score, most lenders require a score of at least 620. Can I use a VA loan to refinance?Yes, VA loans can be used for refinancing through the VA Interest Rate Reduction Refinance Loan (IRRRL) or a cash-out refinance option. Is there a funding fee for VA loans?Yes, a funding fee is required for most VA loans, which helps reduce the loan's cost to taxpayers. The fee can be financed into the loan amount. When considering a VA loan or any other financial options, it's essential to understand the terms and benefits. If you are also interested in leveraging home equity, you might look into fast equity loans as an alternative. https://www.njlenders.com/pages/va-home-loan

What Is a VA Loan? VA loans are a special type of home mortgage reserved for active military members and veterans. These home loans are guaranteed by the U.S. ... https://griffinfunding.com/new-jersey-mortgage-lender/va-loans-new-jersey/

A VA home loan in New Jersey is open to current service members, veterans, and widowed spouses of those who have been killed in action. https://www.vamortgagecenter.com/states/new-jersey-va-loans/

New Jersey VA Loan Limits. As of January 1, 2020, VA borrowers in New Jersey with their full VA loan entitlement are not restricted by VA loan ...

|

|---|